Current 15-year mortgage rate

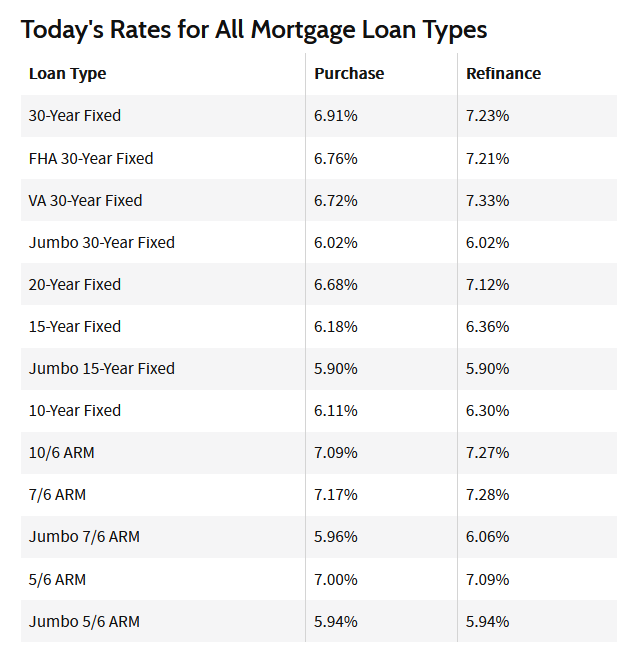

The current fixed 15-year mortgage rate across the US stands at 6.18%, while the jumbo 15-year mortgage rate is 5.90% since April 24, 2023. These specific mortgage rates are definitively not the enticing, temporary rates that lenders use in advertisements, but rather a reflection of what borrowers can reasonably expect to secure with their personal qualifications.

Before reading this, if unsure of what a mortgage is read the mortgage basics for beginners.

15-Year Mortgage Rates vs. 30-Year Mortgage Rates

The standard 30-year mortgage is not the only option available to homeowners. People who qualify for a 15-year mortgage and secure the best rates could potentially save thousands in interest payments. Despite having a larger monthly payment, people who are financially prepared can benefit from lower interest rates. They may also build equity on their home at a quicker rate.

There’s importance in making an informed decision on whether a 15-year mortgage is right for you. It’s crucial to ensure that finances are strong enough to handle the higher payments that come with a shorter-term loan.

Should You Consider a 15-Year Mortgage?

If you can afford to make higher monthly mortgage payments and are looking to save significantly on your home loan, 15-year mortgages may be best for you.

These loans typically come with low interest rates, as agencies supported by the government often apply loan-level cost accommodation that can ramp up the cost of thirty year mortgages.

However, borrowers should carefully decide if they could pay higher monthly payments which are associated with 15-year mortgages compared to the lower payments of both 20 and 30 year long mortgages.

15-Year Mortgages Rates

Mortgage rates are determined by several factors. For example, a credit score, down payment amount, and the current market conditions. The best interest rate you can get may be higher or lower than your areas typical rate, depending on your financial profile.

So, if the prevailing rate is, let’s say 7%, your creditworthiness and other financial factors could lead to being offered a rate of 7.3% or 6.75%.

30-year rates are higher than 15-year rates

Mortgage rates are influenced by the prices of bonds funded securities market for mortgages. Bond investors are interested in low-risk investments with decent returns that maintain inflation rates.

Risks and inflation rates tend to increase with time. Long term loans have bigger interest rates than the shorter-termed ones. It’s challenging for investors to forecast risks and inflation rates far into the future.

Government-supported agencies also impose extra charges on higher loan levels. This causes the cost of thirty year long mortgages to rise. Lots of mortgages with a 15 year term do not have these additional charges, resulting in a decreased interest rate.

What Is a 15-Year Mortgage?

In simple terms, the mortgage is a type of loan designed to finance a home investment. This loan has a fixed interest rate. The payment which is paid monthly, consisting of interest and principal, stays constant throughout the duration of the mortgage.

Unlike a traditional 30-year mortgage, a 15-year mortgage takes half of the time to pay off, thanks to its higher monthly payments. A shortened loan term, coupled with the high monthly payments, leads to significant savings.

Do the Feds Influence Mortgage Rates?

The Federal Reserve’s actions have an impact on mortgage rates. Except they don’t determine them outright. The Fed sets rates for lending federally that banks must pay to borrow from the government for short-term periods.

It is then more costly for Finance institutes to borrow from others, when inter bank rates rise, As a result, they modify their mortgage and loan rates, so they can account for the additional expenses.

It’s worth noting, there are more factors that influence the exact rate that a home buyer is offered, including their credit score, assets, and liability.

15-Year mortgage vs 30-Year

The primary difference between a 30-year and a 15-year mortgage is the repayment period. The mortgage for 30 years requires 360 monthly payments (roughly 30 years), while a 15-year mortgage requires less time.

Although the monthly payments for 30 years are lower because they are spread out among a longer time span, the borrower pays more interest over the years. This is because the borrower is double the payment time compared with a 15-year mortgage. Additionally, a larger interest rate may be charged for a 30-year mortgage.

When should you choose a 15 year long mortgage?

Opting for the 15 year mortgage term is a wise decision for those who wish to reduce their interest expenses while still being able to make bigger payments monthly without jeopardizing their other priorities.

However, it’s important to note that this may not be the best option for everyone. A borrower may not be able to afford the larger monthly payments. If they can’t pay without sacrificing contributions to their savings and retirement accounts, then a mortgage that’s long term may be more suitable.

For those with inconsistent income, this mortgage is only recommended if you have a practical strategy in place to continue making mortgage payments even during tight periods.

If you obtain a mortgage, having a plan in place can result in significant savings

The savings come with a payment that is higher monthly. It’s recommended to shop around for the best rates. Compare terms to ensure your mortgage is affordable and you can comfortably pay for it.

Conclusion

Remember that mortgage rates are subject to daily changes and this information is provided for informational purposes only. An individual’s income and credit profile are the main factors that determine the loan rates and terms they are eligible for. The loan rates do not encompass taxes or insurance premiums, and each lender has their own specific terms and conditions.

To talk 15-year mortgage loans contact us today.